Imagine sifting through a 300-page deal where every page hides important clues, from cash flow waterfalls to subtle risk triggers, that could make or break a deal.

It’s a high-stakes industry, and every decision made based on incomplete or inaccurate information has consequences.

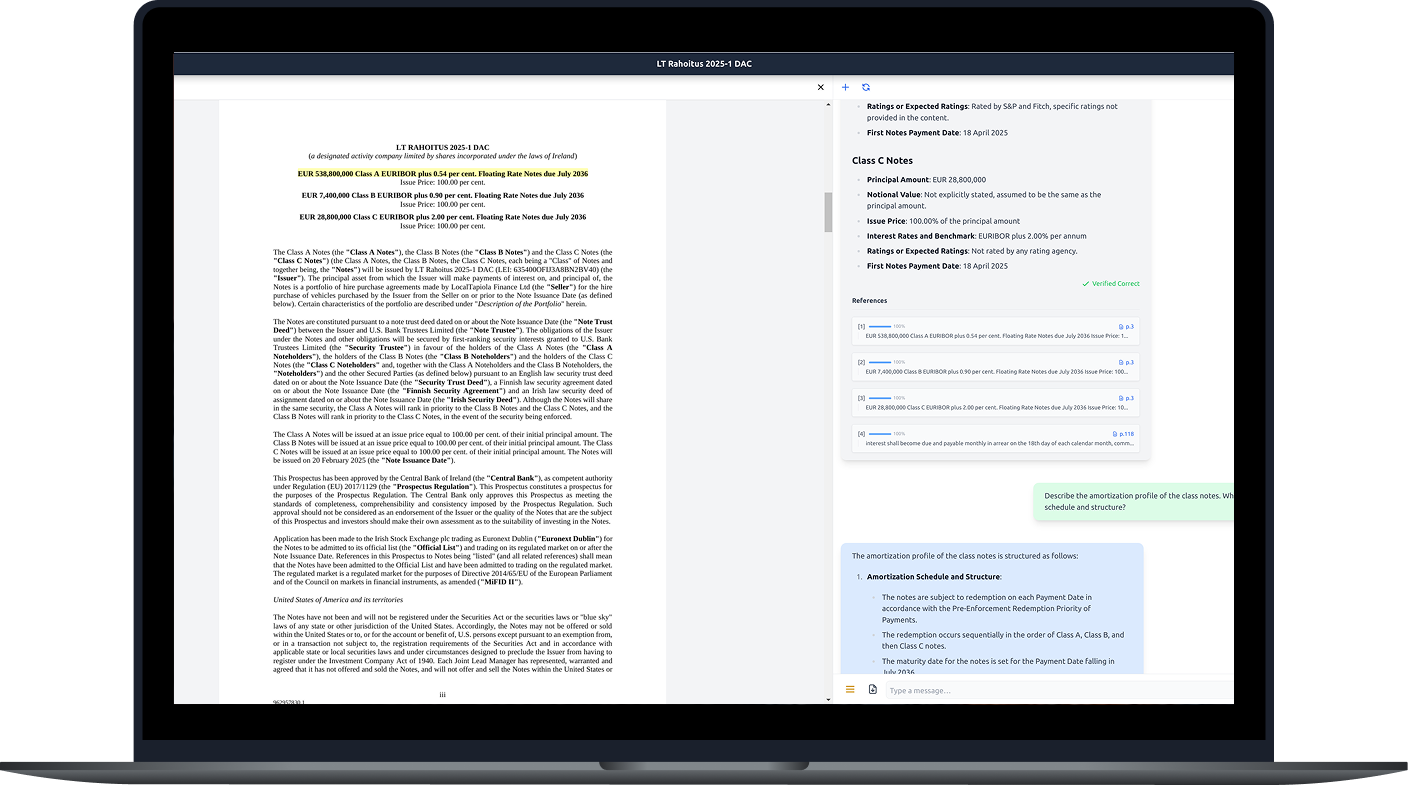

But there’s something that makes navigating this chaos easier. Prospekto by EagleEyeAI is a tool built for the structured finance sector that turns a deal document into a structured dashboard and organizes deal data according to regulator-defined templates.

The Pain of Prospectuses

Deal prospectuses are notoriously dense and complex. They bundle hundreds of pages of detailed metrics, legal disclosures, and intricate cash flow analyses into one document. For professionals on the front lines of structured finance, this means spending hours hunting for essential data points.

The process is time-consuming but also prone to error, as even experts can miss subtle yet critical details buried deep within the text.

One of the key advantages of AI is its ability to process vast amounts of data in seconds. Generative AI takes this further by producing concise summaries that help us quickly understand complex texts. This capability is at the heart of innovative tools like Google’s NotebookLM and Anthropic’s Claude. But with many such tools already available, what makes Prospekto uniquely suited for the structured finance sector?

Prospekto is built for Structured Finance

While the market is flooded with generic “chat-to-document” tools—essentially advanced versions of ChatGPT that extract and summarize text—Prospekto stands apart by being purpose-built for structured finance prospectuses.

Generic tools are designed to extract and summarize text from any document. They don’t actually have any domain context or tailored algorithms to recognize and highlight key metrics, risk factors, legal disclosures, and other nuanced details critical to structured finance documents.

Even with sophisticated language models, the tool may not fully understand the complex financial jargon and regulatory context embedded in a prospectus. This could result in oversimplified responses that miss critical warnings or opportunities.

Prospekto also leverages regulator-defined templates to map the extracted information from a prospectus directly into a formal, standardized data model. This ensures that every transaction is captured with the precision and consistency required for regulatory compliance and facilitates robust, cross-deal analysis.

How Prospekto changes the game

- Review prospectuses faster: Even with experience, reading a deal prospectus is time-consuming. You have to hunt for key details—credit enhancements, triggers, cash flow waterfalls, eligibility criteria—spread across hundreds of pages. Prospekto saves hours per deal by extracting and organizing this info automatically, meaning quicker go/no-go decisions.

- Cut cash flow modeling costs: Cash flow modeling is a major cost driver in structured finance, often relying on legacy tools or proprietary spreadsheets. These systems require hefty licenses, manual data inputs, and specialized expertise to accurately model complex deal structures. Prospekto significantly reduces manual data extraction and streamlines the modeling process by automating the capture of essential deal terms.

This not only cuts costs but also minimizes dependency on third-party tools, allowing asset managers, investors, and issuers to achieve efficiency gains that can lower overall transaction expenses. - Understand relative value: Benchmarking new deals against historical transactions is a critical aspect of structured finance analysis. Investors and risk teams need to understand how a current deal stacks up against similar past transactions.

Prospekto enriches deal analysis with historical data, enabling you to identify patterns, compare key metrics, and spot potential red flags.

This contextual insight helps ensure that deal terms align with market norms and past performance trends. - Analyse unstandardized documents: Private deals often lack standardization disclosures, meaning professionals can’t rely on predefined templates and making it challenging to extract consistent information. Prospekto applies the same extraction process to achieve the same result with private deal documents. This is a significant advantage for those organizations wanting to dabble in the private credit market.

Prospekto passes our validation tests

In our most recent validation test, the Algoritmica team evaluated a diverse sample of prospectuses to ensure that the model reliably extracts key data into both summary and waterfall views.

They verified that our fixed set of questions—which guide data extraction and help detect missing elements— consistently captured critical metrics needed for structured finance, and that the system could cross check these data points against the original document effectively.

These tests make sure Prospekto remains robust and delivers highly accurate, regulator-aligned models for deal prospectuses.

Conclusion

By transforming complex deal prospectuses into structured, regulator-compliant data models, Prospekto saves professionals hours of manual work, reduces costly dependencies, and enhances their ability to make informed, data-driven decisions.

If you feel it’s time to change your approach to deal analysis and streamline your due diligence process, send us a message to explore our testing and validation process first-hand.

Leave a Reply