Author: dylanthiam

-

How Accurate Does GenAI Need to Be in Structured Finance?

A technically accurate response isn’t always useful, and a useful answer isn’t always technically complete. What does this mean for AI in structured finance?

-

AI Meets Structured Finance: Insights from the Hackathon

The Structured Finance Hackathon 2025 showcased innovative prototypes addressing climate risk and financing issues in structured finance. Here are some of the standout tools.

-

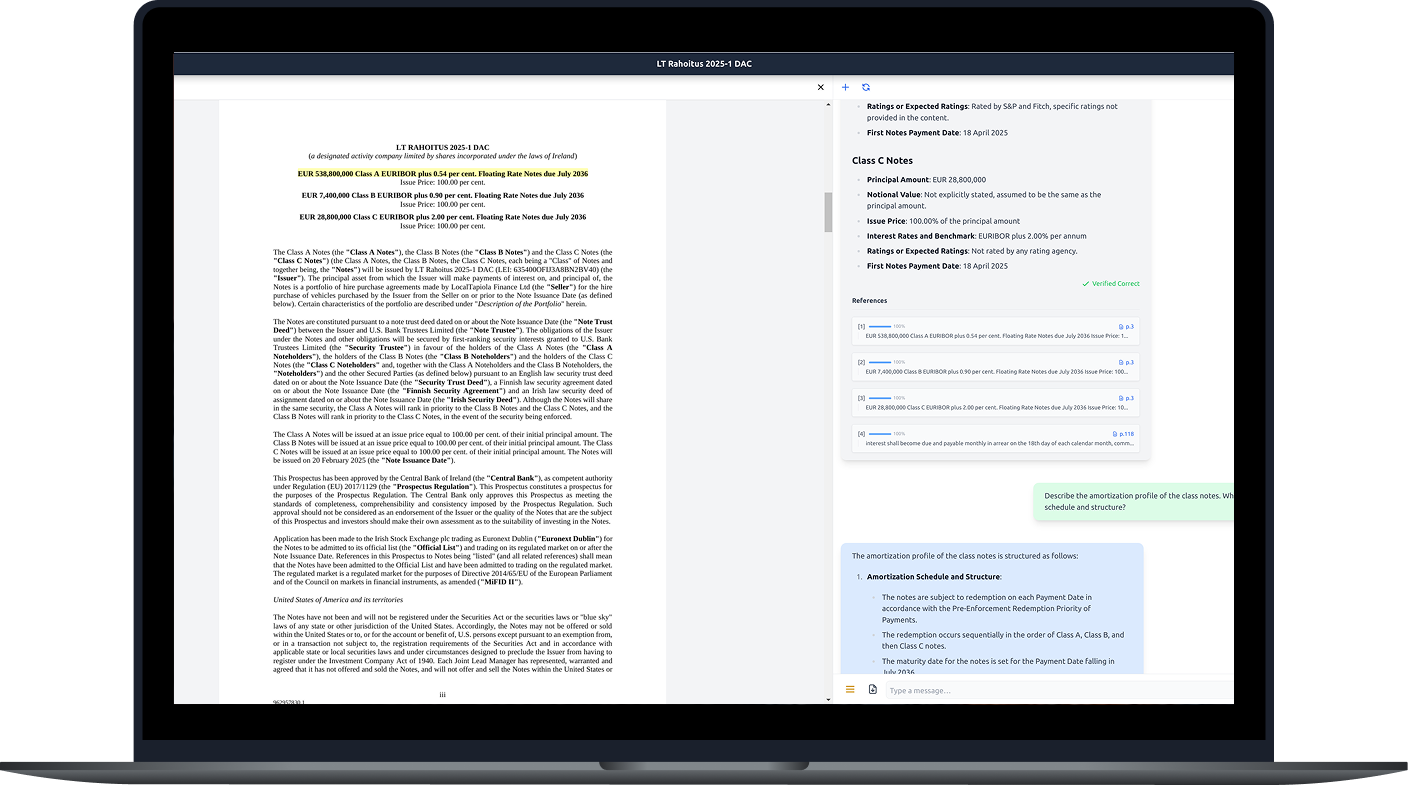

Prospekto: A New Way to Review Deal Prospectuses in Structured Finance

Imagine sifting through a 300-page deal where every page hides important clues, from cash flow waterfalls to subtle risk triggers, that could make or break a deal. It’s a high-stakes industry, and every decision made based on incomplete or inaccurate information has consequences. But there’s something that makes navigating this chaos easier. Prospekto by EagleEyeAI

-

5 Ways AI Impacts Structured Finance

It’s 1994: analysts are skeptical—Lotus 1-2-3 feels safe, but Excel is quietly transforming how analysts get work done. Fast-forward to today, and the structured finance industry is facing a similar shift with the recent advancements in AI.

-

Transforming Structured Finance: Deeploans Goes Open-Source

Data analysis in structured finance just got smarter. Say goodbye to tedious workflows with Deeploans, the open-source ETL framework that improves data quality and accelerates insights.